llc s corp tax calculator

Ad Our Business Specialists Help You Incorporate Your Business. Ad Manage All Your Business Expenses In One Place With QuickBooks.

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official

Tax Calculator in Springfield MA.

. Total receipts 9 million or more. Read customer reviews best sellers. Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets.

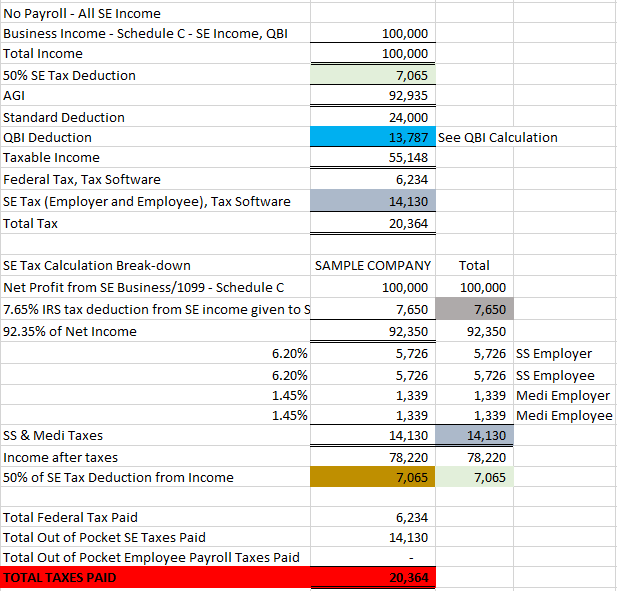

This calculator helps you estimate your potential. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and. Our small business tax calculator has a separate line item for meals and entertainment.

Corporations use the LLC tax rate calculator to determine taxes. The s corporation tax. The 2857 Solution.

Some business structures such as real estate LLCs are exempt from self. Many of our clients choose the latter for several reasons. This offers you an estimate for your business net income for the year to use in our S Corp tax.

Lincoln National Corporation stock lost 36 over a five-day trading period. We Are the Only Solution Available to File S-Corp Election Paperwork Online. Track Everything In One Place.

S corporations that are financial institutions. E-File with IRS State. Annual state LLC S-Corp registration fees.

Forming an S-corporation can help save taxes. Content updated daily for llc tax calculator. Explore The 1 Accounting Software For Small Businesses.

The LLC tax rate calculator is used by corporations to calculate their taxes. Browse discover thousands of unique brands. Ad Looking for llc tax calculator.

Content updated daily for llc tax calculator. Ad Looking for llc tax calculator. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153.

Thinks of an S corporation with a single owner who is the. Annual cost of administering a payroll. Customize a bundle of policies to fit your unique business needs.

Ad Elect Your Company To S Corporation With Just a Few Clicks.

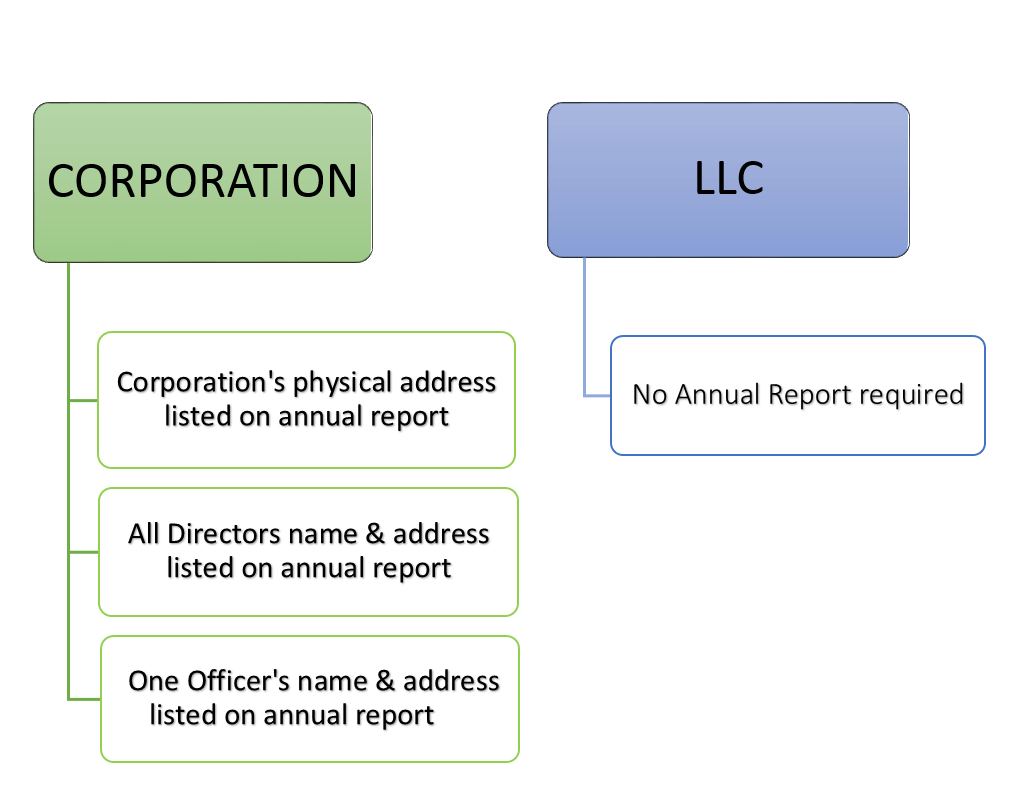

Llc Or Corporation Fxhugheslaw Com

Calculate Your S Corporation Tax Savings Zenbusiness Inc

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

Planning For The S Corporation Election Fixing The Company Agreement

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Corporate Tax In The United States Wikipedia

How To Save On Taxes By Electing To Be Taxed As An S Corp Houston Tx Certified Public Accountant Accounting Tax Financial Services Quickbooks Huda Cpa Firm Pllc

A Beginner S Guide To S Corporation Taxes

Llc Vs Corporation The Differences Harvard Business Services Inc

Llc Tax Calculator Definitive Small Business Tax Estimator

Investment Return Illustration Llc Vs C Corp Central Texas Angel Network

S Corp Tax Rate What Is The S Corp Tax Rate Truic

At Tax Time How To Weigh The Benefits Of A C Corp Vs An S Corp Vs An Llc Vs A Sole Proprietorship Inc Com

Tax Savings Calculator For Llc Vs S Corp Gusto

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

What Is An S Corp Reasonable Salary How To Pay Yourself The Right Way Collective Hub