do nonprofits pay taxes on rental income

You cannot deduct a loss or carry. Churches and religious organizations are almost always nonprofits organized under Section 501 c 3 of the Internal Revenue Code.

Pdf Run Profit And Loss Statement Profit And Loss Statement Statement Template Profit

Nonprofits are also exempt from paying sales tax and property tax.

. Tax-exempt organizations also known as 501 c 3 organizations can have Unrelated. This guide is for you if you represent an organization that is. Calculate state and local sales and lodging taxes even for out of state properties.

Capital Gains and Losses. 1st by the way of salary 2nd by way of contractual payments last by way of professional receipt. An agricultural organization a board.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit. If youre in the 22 marginal tax bracket and have 5000 in rental income to report youll pay 1100. Unrelated business income is typically derived from nonmembers with certain modifications see section IRC 512 a.

Ad Avalara makes it easier to apply the right rental sales tax on your customer bookings. Rental income from real property is taxable. Which Taxes Might a Nonprofit Pay.

Taxes on Rental Income. For the most part nonprofits are exempt from most individual and corporate taxes. The short answer is that rental income is taxed as ordinary income.

A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. Calculate state and local sales and lodging taxes even for out of state properties. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not.

In any of the case if your. You can earn in 3 ways while working for non profit organizations. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

Rental Income and UBTI A Look at the IRS Guidance to Its Auditors. Supplemental Income and Loss. The research to determine whether or not sales.

There are certain circumstances however they may need to. However there are two exceptions where this type of income is taxable. However member dues to.

Published on September 4 2014. Dividends interest rents annuities and other investment income generally are excluded when calculating UBIT. Ad Avalara makes it easier to apply the right rental sales tax on your customer bookings.

In figuring the tax on net investment income a private foundation must include any capital gains and losses from the sale or other. Tax on Net Investment Income. If you do not rent your property to make a profit you can deduct your rental expenses only up to the amount of your rental income.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. To file your rental income youll use Form 1040 and attach Schedule E. On Schedule E youll list your.

Because churches operate to serve. But determining what are an. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate.

Non Profit Budget Budget Template Donation Letter Template Budgeting

Ppp2 For Nonprofits Albin Randall And Bennett

Know These Costs Before You Start Your Nonprofit In 2021 Non Profit Startup Funding Grant Writing

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

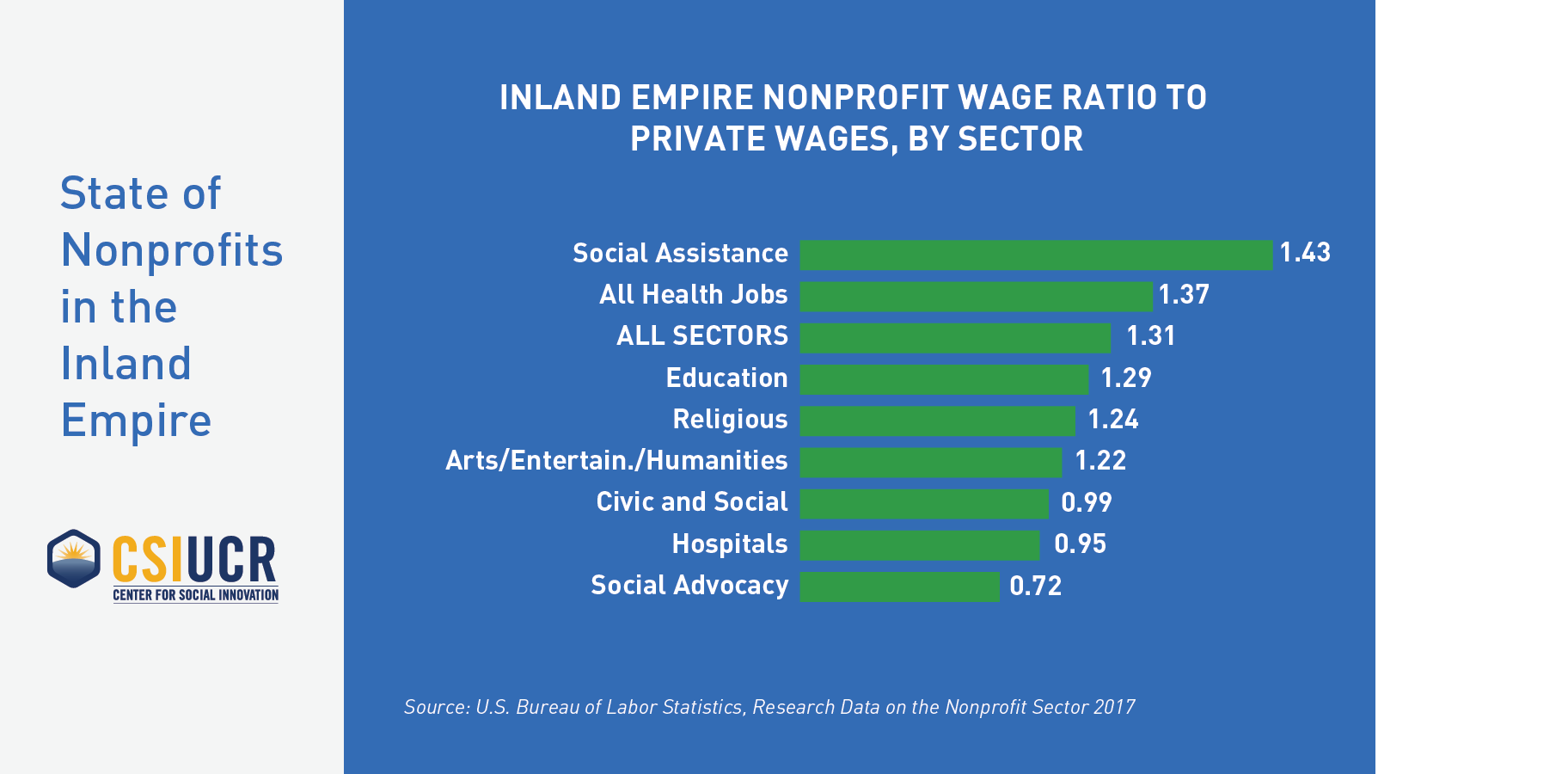

State Of Nonprofits In The Inland Empire Center For Social Innovation

Unrelated Business Taxable Income For Nonprofits Sd Mayer

7 Leasing Tips For Nonprofits The Nonprofit Centers Network

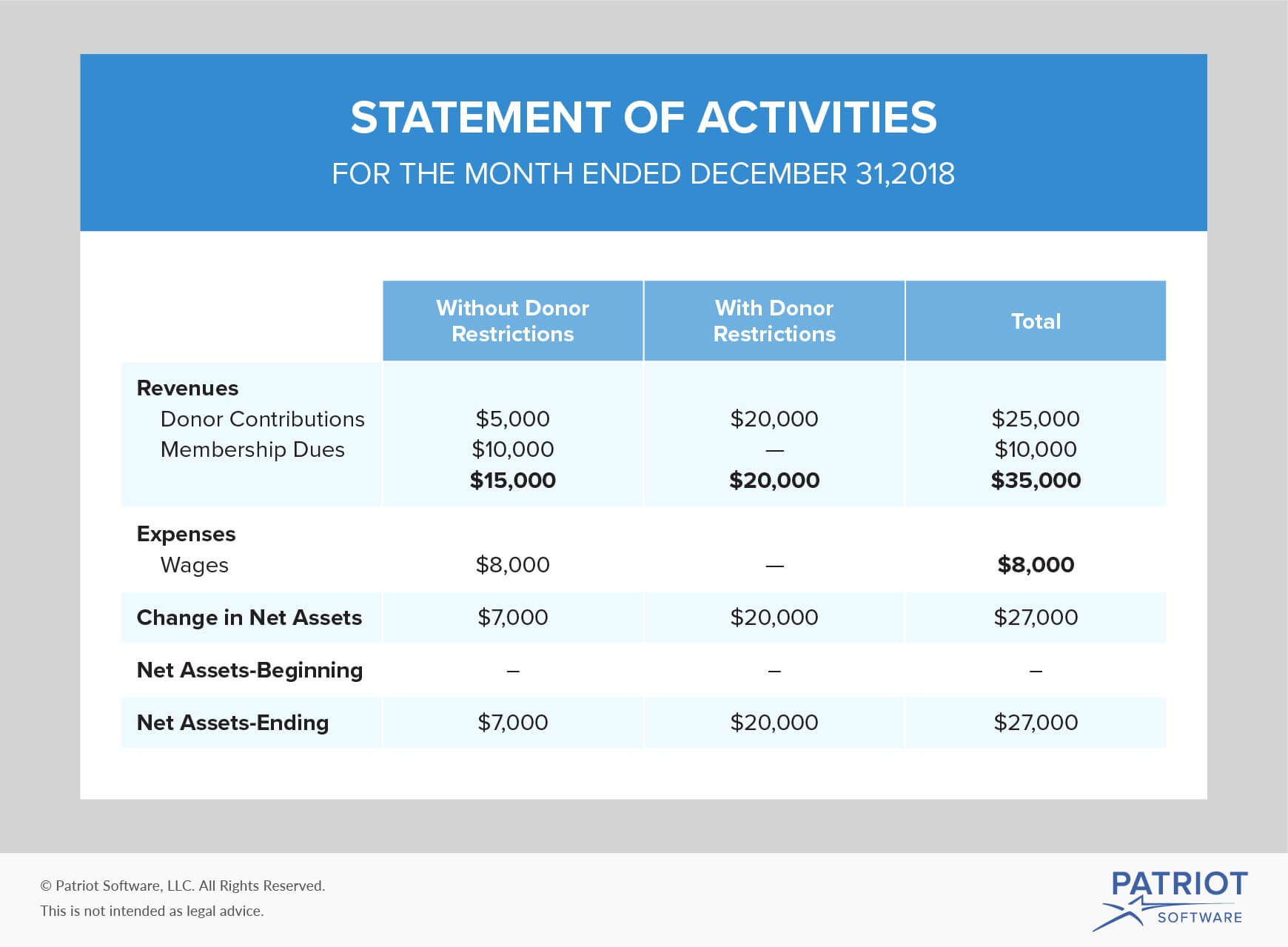

Accounting For Nonprofit Organizations Financial Statements Beyond

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

What Every Nonprofit Board Member Should Know Adler Colvin

Government Grants For Nonprofits Organizations Apply Today 2022

Ubit Issues For Shared Spaces Nonprofit Law Blog

A Guide To Tax Filing Requirements For Nonprofit Organizations

Reporting Nonprofit Operating Expenses Nolo

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Florida Property Appraisers Consider Troubling Position On Property Tax Exemption For Nonprofits Based On Recent Court Decision Batts Morrison Wales Lee P A A Non Profit Cpa Batts Morrison Wales

Converting A For Profit Into A Nonprofit Nonprofit Law Blog

Unrelated Business Income Tax Ubit For 501c3 Nonprofits

Taxable Activities Of Nonprofits A Basic Guide To Ubit Wegner Cpas